Whole Life Insurance

Whole Life Insurance

Whole Life insurance is a valuable asset for your family’s financial well-being. It provides a death benefit and builds cash value for unexpected expenses. The death benefit covers final expenses, outstanding debts and income replacement. The cash value can be accessed for medical emergencies, education expenses, or supplementing retirement. Investing in Whole Life insurance is an important step in your family’s financial planning. Protect what matters most with Whole Life insurance.

Highlights

- 24-Hour Coverage

- Guaranteed Issue - Up to $100,000

- Robust Protection

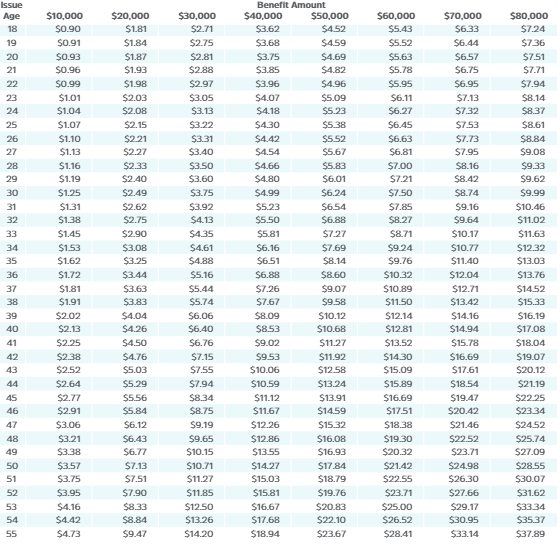

Whole Life Insurance Rates:

This plan is portable which allows you to take it with you even when you no longer work at your position.

Coverage under this plan is guaranteed issue; no medical exams or tests are needed to enroll.

Yes; domestic partners can be covered under this plan. If you have any questions please reach out to your Benefit Advisor.

Questions on your coverage?

Write an Email

Call Us

(515) 400 - 1011