Critical Illness Insurance

Critical Illness Insurance

Critical illness insurance provides a crucial safety net for your family and finances by offering a lump-sum benefit upon diagnosis of a covered serious illness. This coverage ensures that you can focus on recovery without the added stress of financial burdens. It helps cover out-of-pocket medical expenses, daily living costs, or any other financial obligations, allowing you and your loved ones to maintain your standard of living during challenging times. With critical illness insurance, you gain peace of mind knowing that your family’s financial future is safeguarded, enabling you to concentrate on what truly matters—your health and well-being.

Highlights

- Covers Critical Illnesses & Cancers

- Guaranteed Issue

- Robust Protection

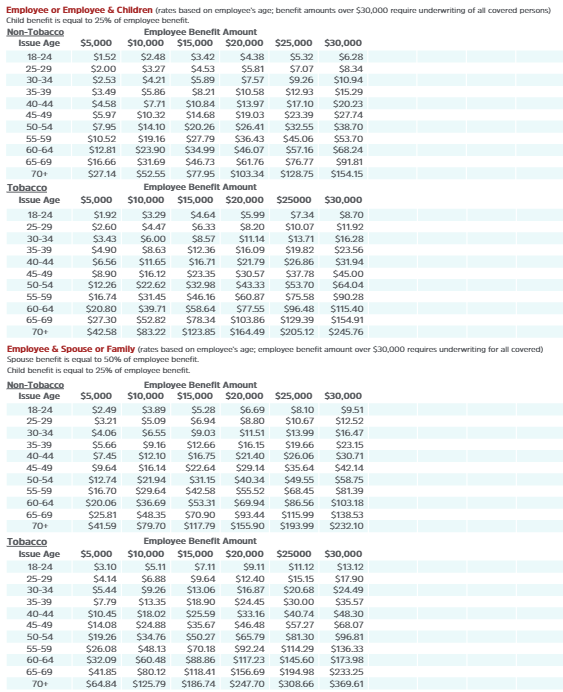

Critical Illness Insurance Rates:

This plan is portable which allows you to take it with you even when you no longer work at your position.

Coverage under this plan is guaranteed issue; no medical exams or tests are needed to enroll.

Yes; domestic partners can be covered under this plan. If you have any questions please reach out to your Benefit Advisor.

Questions on your coverage?

Write an Email

Call Us

(515) 400 - 1011